Life Cycle Parameters

Life Cycle Parameters

In this section, the life cycle cost parameters will be entered so that an analysis can be done to calculate present day values. Life cycle costing is used with building energy simulation in order to justify energy efficiency upgrades. Many alternative building technologies that result in energy savings cost more initially, or may cost more to maintain, than traditional solutions. Using life cycle costs provides a framework to combine initial costs and future costs into a single combined measure, called the “present value.” Present value is a metric that combines all costs and reduces (or discounts) those costs that occur in the future. Discounting future costs is based on the principal of the time value of money.

Also in this section you can define fuel price escalation along with fuel use adjustment multipliers to further define how prices and fuel use can change year to year. The two columns can be set for each fuel type defined in the alternative.

The lifecycle calculations are based on discounting the future values according to normal life-cycle costing techniques as described in NIST Handbook 135 “Life-Cycle Costing Manual for the Federal Energy Management Program.”

In order to make selections for Nominal Discount Rate and Inflation Rate, you will need to select Current Dollar under the Inflation Approach section.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Input Considerations: Lifecycle parameters are common to all project alternatives and changes are automatically applied to all project alternatives, regardless of the active alternative at the time the changes are made.

Length of Study Period in Years

|

Default: 25

|

|

Min & Max: 0 to 100

|

|

Typical Range: 0 to 25

|

|

Units: Years

|

Enter the number of years of the study period. It is the number of years that the study continues based on the start at the base date. Only integers may be used indicating whole years. According to NIST (National Institute of Standards and Technology) Handbook 135, the study period for an LCCA (life cycle cost analysis) is the time over which the costs and benefits related to a capital investment decision are of interest to the decision maker. Thus, the study period begins with the base date and includes both the planning and construction period and the relevant service period for the project.

Base Date

|

Default: Current month and year

|

|

Min & Max: N/A

|

|

Typical Range: January 1990 to December 2100

|

|

Units: N/A

|

Select the month and year that is the beginning of study period, also known as the beginning of the base period. According to NIST 135, the base date is the point in time to which all project-related costs are discounted in a life cycle cost analysis. The base date is usually the first day of the study period for the project, which in turn is usually the date that the life cycle cost analysis is performed. In a constant dollar analysis, the base date usually defines the time reference for the constant dollars (e.g. 2015 constant dollars).

If the base date is set to the date that the life cycle cost analysis is performed, then the constant dollar basis for the analysis will be the current date, and the actual costs as of that date can be used without adjusting for general inflation.

Service Date

|

Default: Current month and year

|

|

Min & Max: N/A

|

|

Typical Range: January 1990 to December 2100

|

|

Units: N/A

|

Enter the month that is the beginning of building occupancy. Energy costs are assumed to occur during the year following the service date. The service date must be the same or later than the Base Date.

Inflation Approach

|

Default: Constant Dollar

|

|

Min & Max: N/A

|

|

Typical Range: N/A

|

|

Units: N/A

|

This field is used to determine if the analysis should use constant dollars or current dollars which is related to how inflation is treated. The two options are:

● Constant Dollar

● Current Dollar

If Constant Dollar is selected, then the Real Discount Rate input is used and it excludes the rate of inflation. If Current Dollar is selected, then the Nominal Discount Rate input is used and it includes the rate of inflation.

According to the NIST Handbook 135: “The constant dollar approach has the advantage of avoiding the need to project future rates of inflation or deflation. The price of a good or service stated in constant dollars is not affected by the rate of general inflation. For example, if the price of a piece of equipment is $1,000 today and $1,050 at the end of a year in which prices, in general, have risen at an annual rate of 5 percent, the price stated in constant dollars is still $1,000; no inflation adjustment is necessary. In contrast, if cash flows are stated in current dollars, future amounts include general inflation, and an adjustment is necessary to convert the current-dollar estimate to its constant-dollar equivalent. This adjustment is important because constant- and current-dollar amounts must not be combined in an LCCA [life cycle cost analysis].*

For most analyses, using the Constant Dollar option will be easier since the effect of inflation may be ignored.

Real Discount Rate

|

Default: 3%

|

|

Min & Max: 0 to 100%

|

|

Typical Range: 0 to 10%

|

|

Units: %

|

Enter the real discount rate as a percentage. This input is used when the Inflation Approach is Constant Dollar. The real discount rate reflects the interest rates needed to make current and future expenditures have comparable equivalent values when general inflation is ignored. When Inflation Approach is set to Current Dollar this input is ignored and not shown.

Nominal Discount Rate

|

Default: 5%

|

|

Min & Max: 0 to 100%

|

|

Typical Range: 0 to 10%

|

|

Units: %

|

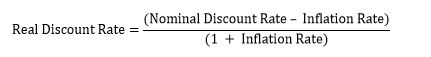

Enter the nominal discount rate as a percentage. This input is used when the Inflation Approach is Current Dollar. The real discount rate reflects the interest rates needed to make current and future expenditures have comparable equivalent values when general inflation is included. When Inflation Approach is set to Constant Dollar this input is ignored and not shown. The equation that links nominal and real discount rates is:

Inflation Rate

|

Default: 2%

|

|

Min & Max: 0 to 100%

|

|

Typical Range: 0 to 10%

|

|

Units: %

|

Enter the rate of inflation for general goods and services as a percentage. This input is used when the Inflation Approach is Current Dollar.

Discounting Convention

Default: Beginning of Year

The field specifies whether discounting of future costs should be computed as occurring at the end of each year, the middle of each year, or the beginning of each year. The most common discounting convention uses the end of each year. Without a specific reason, the end of each year should be used. Some military projects may specifically require using the middle of each year. The year being used starts with the base year and month and repeats every full year. All costs assumed to occur during that duration are accumulated and shown as an expense either at the beginning, middle or end of the year. The options are:

● Beginning of Year

● Mid Year

● End of Year

Marginal Tax Rate

|

Default: 0%

|

|

Min & Max: 0 to 30%

|

|

Typical Range: 0 to 100%

|

|

Units: %

|

Enter the overall marginal tax rate for the project costs. This does not include energy or water taxes. The single tax rate entered here is not intended to be a replacement of the complex calculations necessary to compute personal or corporate taxes; instead it is an approximation that may be used for a simple analysis assuming a constant tax rate is applied on all costs. The tax rate entered should be based on the marginal tax rate for the entity and not the average tax rate. Enter the tax rate results in present value calculations after taxes. Most analyses do not factor in the impact of taxes and assume that all options under consideration have roughly the same tax impact. Due to this, many times the tax rate can be left to default to zero and the present value results before taxes are used to make decisions. The value should be entered as a percentage

Depreciation Method

|

Default: None

|

|

Min & Max: N/A

|

|

Typical Range: N/A

|

|

Units: N/A

|

For an analysis that includes income tax impacts, this entry describes how capital costs are depreciated. According to IRS Publication 946 - How to Depreciate Property “Depreciation is an annual income tax deduction that allows you to recover the cost or other basis of certain property over the time you use the property. It is an allowance for Fair Market Value the wear and tear, deterioration, or obsolescence of the intangible property.” Details on which depreciation method to choose depends on the property being depreciated and IRS Publication 946 and a good accountant are the best sources of information in determining which depreciation method to choose. Only one depreciation method may be used for an analysis and is applied to all capital expenditures. Only analyses that include tax impacts need to select a depreciation method.

The options are:

● Modified Accelerated Cost Recovery System-3year

● Modified Accelerated Cost Recovery System-5year

● Modified Accelerated Cost Recovery System-7year

● Modified Accelerated Cost Recovery System-10year

● Modified Accelerated Cost Recovery System-15year

● Modified Accelerated Cost Recovery System-20year

● Straight Line-27year

● Straight Line-31year

● Straight Line-39year

● Straight Line-40year

● None

Depreciation allowances reduce the actual/nominal tax dollars paid by the owner. Thus, analyses using depreciation should be conducted in nominal dollars. For an analysis that does not include tax effects, “None” should be selected.

Price Escalation

|

Default: 1

|

|

Min & Max: 0 to 100

|

|

Typical Range: N/A

|

|

Units: N/A

|

The escalation in price of the energy or water use for the first year expressed as a decimal. The values for this object may be found in the annual supplement to NIST Handbook 135 in Tables Ca-1 to Ca-5. According to the NIST 135 supplement, the values are “present projected fuel price indices for the four Census Regions and for the United States. These indices, when multiplied by annual energy costs computed at base-date prices provide estimates of future-year costs in constant base-date dollars. Constant-dollar cost estimates are needed when discounting is performed with a real discount rate (i.e., a rate that does not include general price inflation).” For no change enter 1.0. Select the fuel or water from the dropdown above the table.

Use Adjustment Multiplier

|

Default: 1

|

|

Min & Max: 0 to 100

|

|

Typical Range: N/A

|

|

Units: N/A

|

Using this input, fuel or water use costs for future years may be adjusted. This should not be used for compensating for inflation but should only be used to increase the costs of energy or water based on assumed changes to the actual use of water or energy, such as due to changes in the future function of the building or the impact of future adjacent buildings on energy use. This object is not commonly used and should be used with caution. The adjustments begin at the start of the service period.

The multiplier to be applied to the end use cost for the first year in the service period. The total utility costs for the selected end use is multiplied by this value. For no change enter 1.0. Select the fuel or water from the dropdown above the table.